Opportunity Cost Is Calculated by Which of the Following

Opportunity costs can be calculated using the following formula. Order two will derive a Revenue worth INR 1200000 and will cost INR 800000.

Calculating Opportunity Cost Microeconomics

Every opportunity you create will result in.

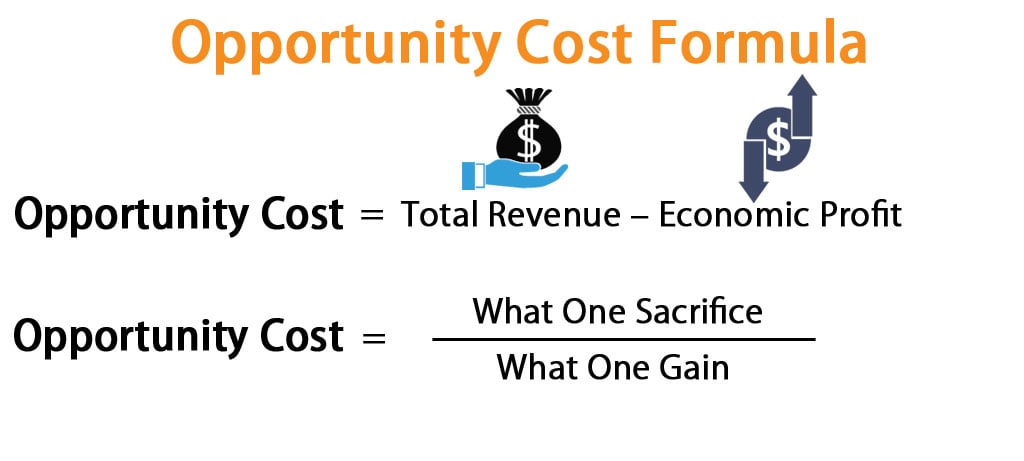

. Instead there is a common mathematical method for assessing it and coming up with useful figures. They found that in the past year they made 100000 selling ice cream and spent 75000 on supplies and factory space. Opportunity cost What you are sacrificing What are you gaining.

For example if a car manufacturer could produce 10 cars worth 8000 each or 5 trucks worth 12000 each per day the opportunity cost of choosing to produce trucks instead of cars is 20000 as. Assessing opportunity cost involves. Opportunity cost refers to what must be given up in order to obtain some item.

NPV Formula A guide to the NPV formula in Excel when performing financial analysis. How to Calculate Opportunity Costs. Minimizing profit and loss.

But opportunity cost can also be calculated simply by dividing the cost of what is given up by what is gained. OC FO CO where. The value per opportunity is calculated by multiplying your close rate by the average selling price ASP.

Evaluate cost by hour day week or year for each option. Bellingway uses the opportunity cost formula to make a decision. Opportunity cost is calculated by using the following formula O p p o r t u n i t y c o s t R F O R C O.

Economic profit or loss is equal to total revenue minus explicit and implicit costs. Order one will derive a Revenue of INR 1000000 and Costs 400000. Making choices and dealing with consequences.

NPV F 1 rn where PV Present. There cannot be any other alternative. While opportunity cost can be evaluated while making decisions it is most accurate when comparing previous judgments.

Rescooperate Ice Cream Shop recently analyzed their books. Opportunity cost is calculated by applying the following formula. Opportunity cost is not always measured in terms of money it can be calculated based on other factors such as time and satisfaction etc.

Given the versatility of the concept opportunity cost doesnt have a clearly defined or designated formula. What is a graphical representation of the combination of goods and services that can be produced in a. Based on the above formula opportunity cost can easily be calculated by finding the difference between the expected returns on each option.

This can be cash weight or products. Here the opportunity cost of producing furniture is the number of papers that are foregone. However the following is a formula that some businesses use to calculate opportunity costs when possible.

For example say that your company has the opportunity to use. The remaining 25000 represents. OC is Opportunity Cost FO is the returns on best forgone option And CO is the returns on chosen option.

The result shows that the company could earn 5 less if it invests in an upgrade of its existing branch instead of a new branch. Return on best foregone option FO - return on chosen option CO opportunity cost. Opportunity Cost Return on Foregone Alternative Option Return on Chosen Option.

The equation for any budget constraint is the following. Opportunity cost is the potential loss from a missed opportunitythe result of choosing one alternative and forgoing another. RCO Return on the chosen option.

This method is as follows. Opportunity costs are calculated by comparing the returns of various investment options and summing the money lost if one alternative is chosen over another. Every opportunity you create will result in.

This concludes the topic on the Opportunity cost formula which is a very important concept for calculating the opportunity cost in a business. The most significant limitation of opportunity cost is the difficulty. RFO Return on the next best-forsaken option.

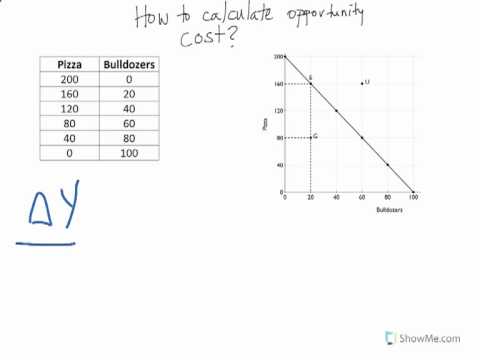

This is easy to see while looking at the graph but opportunity cost can also be calculated simply by dividing the cost of what is given up by what is gained. For example if a company brought in 10m in revenue and had 6m of explicit costs and 3m of implicit costs then it had an economic profit of 1m 10 6 3 1. OC 10 - 15 -5.

The following is the formula for calculating opportunity cost. Alternatively the opportunity cost can be calculated with hindsight by comparing returns since the decision was made. One method for studying opportunity cost is to think in terms of.

For example the opportunity cost of the burger is the cost of the burger divided by the cost of the bus ticket or latexfrac2000504latex The opportunity cost of a bus. This can be done during the decision-making process by estimating future returns. Based on the following data choose which one to operate and the opportunity costs.

Suppose your close rate is 35 and your ASP is 10000 then your value per opportunity is 35 x 10000 3500. Choosing consequences over rewards. For example the opportunity cost of the burger is the cost of the burger divided by the cost of the bus ticket or latexfrac2000504latex.

Opportunity Cost Return on Most Profitable Investment Choice Return on Investment Chosen to Pursue13-May-2021. The formula is simply the difference between what the expected returns are of each option. By admin February 16 2022.

In financial analysis the opportunity cost is factored into the present when calculating the Net Present Value formula. Making choices and dealing with consequences. Aspects of Opportunity Cost.

Reviewing past decisions and changing them. However the new branch is projected to return 15 within the same period. The value per opportunity is calculated by multiplying your close rate by the average selling price ASP.

Suppose your close rate is 35 and your ASP is 10000 then your value per opportunity is 35 x 10000 3500. An investor calculates the opportunity cost by comparing the returns of two options. The opportunity cost of a product is the best alternative that was foregone.

RFO - RCO Opportunitycost RFORCO. Opportunity cost OC FO - CO. To calculate the opportunity cost compare each opportunity based on a similar unit of measurement.

Therefore economic profit does take opportunity cost into account. Its important to understand exactly how the NPV formula works in Excel and the math behind it.

How To Calculate Opportunity Cost Youtube

Opportunity Cost Formula Calculator Excel Template

Opportunity Cost Meaning Importance Calculation And More

How To Graph And Read The Production Possibilities Frontier Economics Lessons Economics Lessons College Teaching Economics

No comments for "Opportunity Cost Is Calculated by Which of the Following"

Post a Comment